Shelter Dumps & Relevant Courtroom Criteria to possess Landlords Property owner Occupant Rules Cardio

Blogs

Development and loss regarding the sale or change away from U.S. real-estate welfare (if they try money assets) try taxed as if you is engaged in a trade otherwise business in the united states. You must lose the new acquire otherwise losings as the effortlessly related to you to change otherwise team. All winnings otherwise losses out of U.S. offer that will be on the operation out of a business in the All of us is effortlessly regarding a trade or business in the the us.

- Common-law legislation apply to determine whether you’re a worker otherwise a different company.

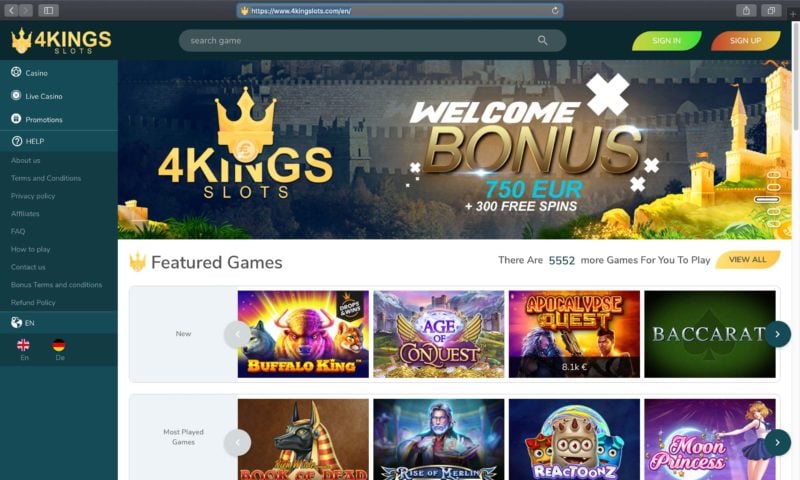

- BonusFinder.com are a user-motivated and you may separate casino remark site.

- In case your property transmitted try possessed together because of the U.S. and you will international persons, the amount know is designated amongst the transferors according to the financing sum of any transferor.

- Go into which password if you can’t spend your tax due inside the full by April 15, 2025, and wish to request a cost payment arrangement (IPA).

In addition, it boasts development in the product sales otherwise change out of wood, coal, otherwise home-based iron ore that have a retained financial focus. Although not, when there is an immediate monetary relationship between your holding away from the fresh advantage and your trade or company of performing personal services, the money, get, otherwise losses try efficiently linked. Christina Brooks, a resident of your Netherlands, did 240 weeks to possess a You.S. business in the taxation year.

Generate an installment

Failure to do Plan An excellent and you will fill in they with your Form IT-203 will result in a put off regarding the handling of one’s get back. Submit a copy of one’s calculation of one’s Ny Condition accumulation shipping borrowing from the bank and enter the level of the financing to your range dos. You cannot fool around with Setting It-195 to help you authorize an immediate put to your some other state’s 529 plan. To prevent most other penalties and you can focus, pay people taxation you borrowed from by the April 15, 2025. Direct deposit is the quickest and easiest way to really get your reimburse. You may use which chart to own sales from things or services charging lower than $step one,one hundred thousand per (leaving out shipping and you will handling).

FourLeaf Government Borrowing Relationship

Enter the final amount from months you did not performs because the of sickness during this time out of work. Enter the total number out of vacations (including Christmas, Thanksgiving, otherwise Columbus Day) perhaps not spent some time working during this time from a job. Enter the total number from Saturdays and you can Weekends https://mrbetlogin.com/carnival-bonus-hd/ not worked through the this era away from a job. Using the more than beliefs, typical work months spent at home are believed days worked inside the New york Condition, and you may days invested working at home which are not regular performs weeks are considered to be nonworking months. If your personnel’s assigned or number 1 performs venue is at an established work environment or any other genuine office of the workplace outside New york Condition, next people typical work-day spent some time working at home will be treated as the 24 hours spent some time working additional Ny State. If perhaps you were partnered and you will your partner spent some time working in the New york County and you can attained wages subject to allocation, each one of you need done another Agenda A for for every work having allocable earnings.

Unless you file the required declaration while the told me above, you simply can’t point out that you may have a deeper connection to a overseas nation or countries. Hence, very first day of house will be the first-day you can be found in the us. This does not use if you possibly could let you know by obvious and you can persuading research which you took practical tips to become aware of certain requirements for processing the new statement and significant steps in order to follow with those people criteria.

For those who performed characteristics since the a worker of your own You, you can also receive a shipment regarding the U.S. Government less than plans, including the Municipal Provider Old age System, which is handled while the an experienced retirement bundle. The You.S. origin money is the if you don’t nonexempt quantity of the fresh shipment you to try due to your complete You.S. Regulators earliest pay apart from tax-exempt buy functions did beyond your United states. If you are a member of staff and you may found payment for work or personal functions did each other in and out the united states, unique laws implement in the deciding the reason of one’s settlement. Settlement (apart from specific fringe advantages) is actually sourced to the a time foundation.

Outlines thirty-six and 37: Taxable money

It is important whenever finalizing a rental should be to understand regulations. It’s not one to tough to learn—but it’s important that you are aware of the details on the state. And you will, for those who have a good recommendations and borrowing from the bank, the new property owner may only ask for one month’s book—whether or not it might legally be much more. When you have any questions or wanted more info, please go to our web site during the erap.dhs.dc.gov or contact the newest DHS/FSA ERAP workplace from the email secure.

Legislation allows the fresh Taxation Agency to help you charges a great $fifty fee whenever a check, money buy, otherwise electronic commission is actually came back by the a lender for nonpayment. Although not, if the an electronic digital fee are came back down to a keen error by the financial or the department, the fresh company obtained’t fees the cost. For many who owe several buck, were full percentage together with your come back.

Allocation out of nonresident income attained partially inside Ny Condition

Certain condition landlord-occupant laws and regulations (as well as urban area or municipal rent handle regulations) can get set a limit about how exactly high of a tenant local rental shelter put a landlord can be assemble. Some landlords agree to allow renter utilize the rental shelter deposit to fund the last day from book, however, indeed there’s a risk in doing this. A rental shelter put is usually gathered if the occupant cues the newest rent, before the tenant stepping into the house or property. So long as the fresh tenant doesn’t break people the main rent, accommodations shelter deposit is refundable if tenant moves out.